Start Your Custom Quote Process™

Malpractice Insurance for Doctors & Physicians in Arizona

Let our specialists compare medical malpractice insurance quotes for your practice in Arizona

Our partners

Table of contents

- Medical Liability Claims Trends for Arizona Healthcare Providers

- How to buy malpractice insurance in Arizona.

- How to save money on your malpractice insurance.

- How much does medical malpractice insurance cost in Arizona?

- Medical malpractice requirements in Arizona.

- Find Coverage for your Practice

- Client Testimonials

- Best medical malpractice insurance companies in Arizona.

- Why partner with Cunningham Group in Arizona?

- Historic medical malpractice insurance rates in Arizona – since 2000.

- History of malpractice insurance in Arizona.

- Resources for Physicians.

Arizona Malpractice Insurance

Arizona malpractice insurance premiums are relatively expensive. Policies are available from a variety of carriers, which is beneficial to physicians, but barriers to passing medical liability reforms have proved difficult to overcome.

Our 2023 Physician Buyers Guide for purchasing malpractice insurance in Arizona gives you the information necessary to obtain the strongest, most financially secure policy at the best price. When shopping for coverage, you need a full view of the Arizona marketplace to find the company that best fits your situation. Choose a broker that can offer multiple quotes from all the major malpractice insurance companies in Arizona.

Medical Liability Claims Trends for Arizona Healthcare Providers

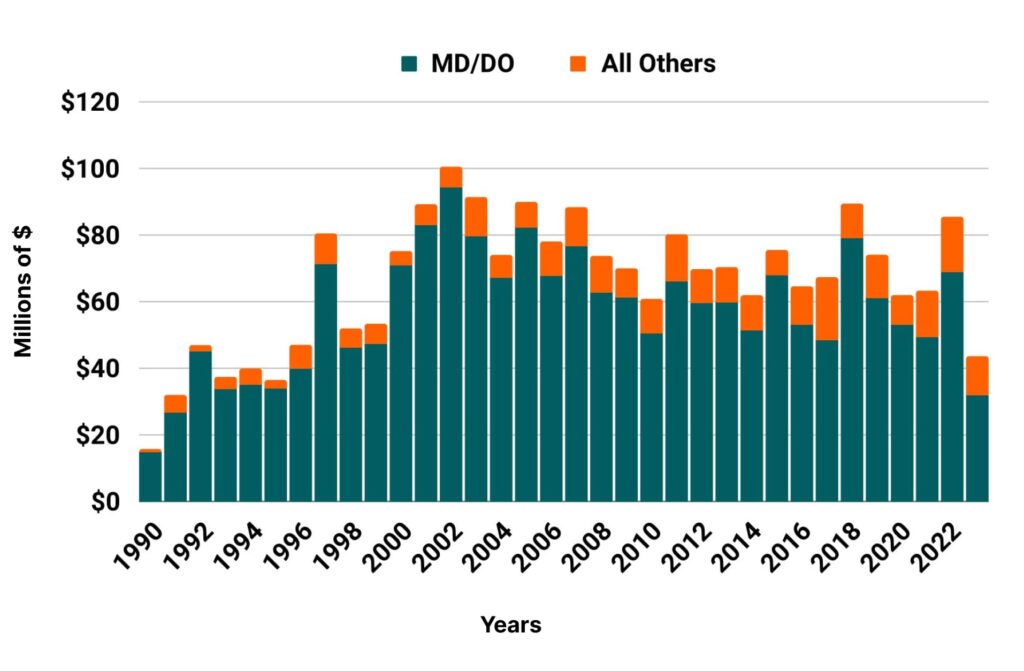

Arizona NPDB from 1990 to 2023

How to buy malpractice insurance in Arizona

The best way to buy malpractice coverage is to work with a reputable malpractice insurance broker in Arizona who can generate multiple quotes. Your broker will walk you through the lengthy insurance application and underwriting process. Click to get your free medical malpractice insurance quotes from all the major Arizona malpractice insurance companies.

Typically, the malpractice insurance purchasing process goes like this:

- Submit your information for your free medical malpractice insurance quote from every major insurance company in Arizona.

- One of our veteran malpractice insurance agents who specializes in the Arizona market will contact you to learn more about your specific needs.

- We shop your coverage to every major insurance company in Arizona.

- We present you with a number of insurance quotes and give you the information necessary to make an educated and informed decision. Don’t worry. We’re here every step of the way, helping you get the best price with the best company.

- At renewal time, we restart the process of shopping your coverage among every major carrier to keep your policy properly priced.

How to save money on your malpractice insurance

- The easiest way to save money on your medical malpractice insurance policy is by working with a broker who has the access to generate quotes from every major insurance company, offering an accurate view of the marketplace. As one of the top brokers in Arizona, we can guide you through the application and underwriting process so you’re confident you secured the best price with the right insurer for your situation.

- The most common limits in Arizona are $1 million/$3 million. Limits of liability play a major role in determining the overall cost of your policy. Some companies will offer lower limits to save you money. We don’t recommend this. We want your risks fully indemnified so you never have to pay an award out of pocket. Let us save you money by shopping your coverage rather than skimp on protection.

- Check out our 7 secrets your medical malpractice insurance agent won’t tell you page to get insider information on buying coverage in Arizona.

- The most common limits in Arizona are $1 million/$3 million. Limits of liability play a major role in determining you overall cost. Some companies might recommend lowering your limits to lower your malpractice premium cost. We do not. We do not ever want to see client forced to pay a verdict out of pocket.

How much does medical malpractice insurance cost in Arizona?

Rates for physician malpractice insurance don’t vary much depending on where you practice within the state. Most major insurance companies classify Arizona as a single territory, which means your specialty’s base rate does not vary depending on your practice address. But you still want multiple quotes to get an accurate view of the marketplace. This is one of the many reasons it’s important to work with an insurance agency that specializes in medical malpractice insurance. Below are mature, base rates with no credits or discounts. We typically get our clients a 30-50% reduction from these rates:

Arizona

- Internal Medicine Average Rate $10,006

- General Surgeon Average Rate $35,490

- OB/gyn – Average Rate $45,237

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Medical malpractice requirements in Arizona

Limits of Liability: The most important requirement are the limits of liability in Arizona which are $1 million/$3 million. What this means is that the insurance company we help place you with will cover you during the policy period up to $1 million per claim, with a cap of $3 million per year.

Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Some of the hospital systems requiring this include, but are not limited to: Banner, Valleywise Health Medical Center, and Phoenix Children’s Hospital.

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Family Practice in ArizonaMy experience with David was the best interaction I have ever had with professional liability agent. I called to obtain liability insurance for my practice and David was very quick to find me several options with the best quotes. The customer support and responsiveness I was given is hard to find. David was very rapid in response and very helpful in every aspect of obtaining my coverage.

OB in ArizonaDavid made the whole process less stressful. He was extremely courteous and prompt! I appreciate all of the help. Thanks so much again.

Best Medical malpractice insurance companies in Arizona

- Medical Protective

- The Doctors Company

- NORCAL

- ProAssurance

- Aspen

Why partner with Cunningham Group?

Partnering with Cunningham Group will give you a full view of the Arizona marketplace. We can get you quotes from all the major insurance companies and help you choose the policy that best fits your needs and budget. Our veteran insurance agents average 10+ years of industry experience. Let us help you secure medical malpractice insurance quotes from every major insurance company in Arizona.

Historic Medical Malpractice Insurance Rates in Arizona for Physicians

Brief History and other important facts of medical malpractice insurance in Arizona

According to data from the National Practitioner Databank (NPDB), Arizona has fewer medical malpractice claims per 100 physicians than the national average; in 2019, Arizona had 0.61 claims per 100 physicians, compared to the U.S. figure of 0.93. Arizona also spent less per capita to pay out medical malpractice claims than the national average, at per capita $7.53 compared to $9.98 nationwide. Despite these positive figures, rates in Arizona have stayed higher in comparison to many other states.

Medical liability reform has not been successful in Arizona, but it hasn’t been for lack of trying. Arizona is one of several states with a constitution which specifically limits the ability of its legislative branch to pass tort reforms. There are three specific sections in the Arizona constitution that explicitly void the legislature’s ability to pass laws restricting access to the court system and/or compensation for injury as determined by a jury, including two sections that prohibit the legislature from limiting the amount of recoverable damages in tort cases. Lawmakers attempted ballot initiatives to change the constitution’s language in 1986, 1990 and 1994, but were defeated each time. More limited reforms have passed in Arizona, including a 2010 law to reform the standards for expert witness testimony and evidence. In 2017, the state Supreme Court clarified questions about the qualifications of expert witnesses in medical malpractice lawsuits. According to the court, an expert witness must have been engaged in active clinical practice or teaching the year immediately preceding the injury.

Frustrated by his state’s constitutional restriction on restricting the size of jury verdicts in medical malpractice cases, Republican Gov. Doug Ducey has been one of the most-vocal governors to support the federal Protecting Access to Care Act, which would create a $250,000 cap on noneconomic damages in medical liability lawsuits, among other provisions that would preempt state laws governing medical malpractice lawsuits in the areas of statutes of limitation, joint and several liability, product liability and attorney contingency fees. The Protecting Access to Care Act was passed by the U.S. House of Representatives in June of 2017, but did not receive a vote in the Senate.