Start Your Custom Quote Process™

Medical Malpractice Insurance for Ohio

Compare Quotes from Every Major Medical Malpractice Carrier in Ohio

Our partners

Table of Contents

- Medical Liability Claims Trends for Ohio Healthcare Providers

- Malpractice Insurance Requirements for Ohio Physicians

- Why Malpractice Insurance Still Matters in Ohio

- What Factors Impact Malpractice Insurance Rates in Ohio?

- Client Testimonials

- How to Get the Best Malpractice Coverage in Ohio

- Historic Medical Malpractice Insurance Rates in Ohio for Physicians

- Frequently Asked Questions: Ohio Medical Malpractice Insurance

- Get a Quote from All Major Ohio Carriers

- Resources for Physicians.

What Medical Professionals in Ohio Should Know About Malpractice Coverage

Ohio’s medical community understands the critical importance of malpractice coverage, even where it isn’t legally required. With a mix of large academic centers, rural clinics, and changing legal precedents, coverage isn’t just protection, it’s a matter of peace of mind. Whether you’re practicing in Akron, Cincinnati, or Columbus, malpractice insurance plays a crucial role in maintaining professional continuity and resilience.

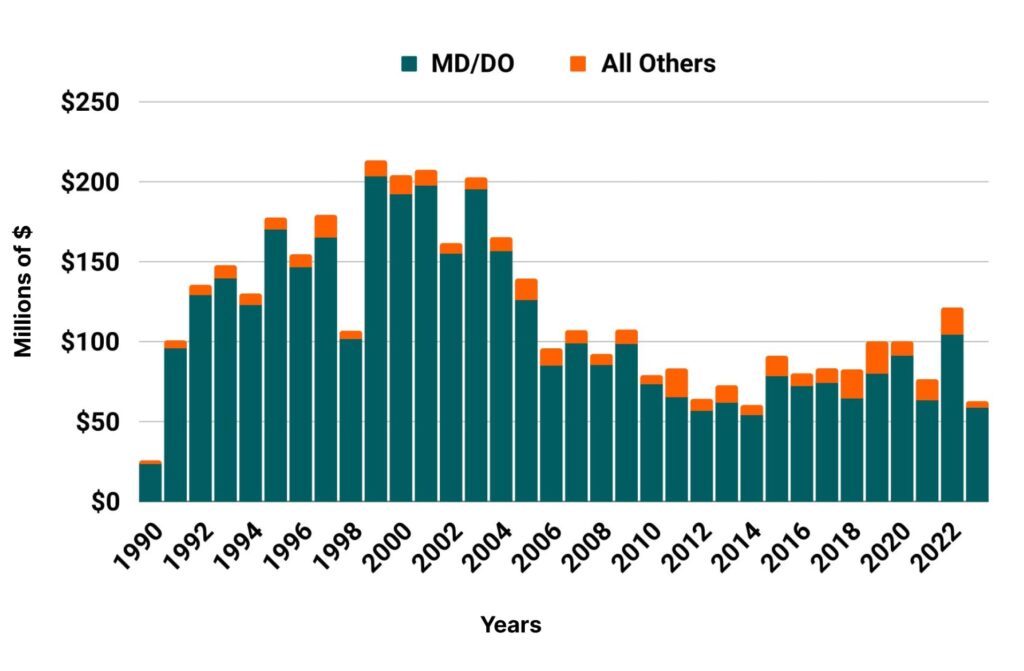

Medical Liability Claims Trends for Ohio Healthcare Providers

Ohio NPDB from 1990 to 2023

Malpractice Insurance Requirements for Ohio Physicians

Ohio doesn’t mandate malpractice insurance statewide, but in reality, effective coverage is a de facto requirement. Hospitals and systems like Cleveland Clinic, OhioHealth, and University Hospitals require it for credentialing and employment. The industry-standard liability coverage is typically $1 million per claim / $3 million aggregate, and it’s essential for credentialing, hospital affiliation, and participating in payer networks.

Why Malpractice Insurance Still Matters in Ohio

While Ohio has implemented tort reform measures such as damage caps and limits on attorney fees, malpractice risk remains a real and variable threat. Even modest jury awards and legal defense costs can strain your practice finances. Having the right insurance policy provides crucial support if a claim emerges, helping defend your reputation, protect your hard-won credentials, and preserve your practice’s stability.

What Factors Impact Malpractice Insurance Rates in Ohio?

Most insurers treat Ohio as one rating territory, but your individual premium will still be shaped by:

- Specialty: High-risk specialties like surgery, anesthesiology, and OB/GYN often carry higher base rates.

- Policy Type: Claims-made policies typically cost less initially but require tail coverage; occurrence policies are more expensive upfront but eliminate that need.

- Claims History: Even past allegations can increase your underwriting risk.

- Coverage Limits: Greater limits offer more protection but with increased premiums.

- Workload: Higher patient volumes or procedural focus can elevate exposure.

This is why comparing multiple carrier quotes is so essential, it’s the best way to ensure you’re paying a fair rate for your specific risk profile.

Request a free quote »

Ohio

- Internal Medicine Average Rate $5,877

- General Surgeon Average Rate $41,928

- OB/gyn – Average Rate $54,255

Other Specialties

The cost of your malpractice coverage can vary greatly due to a number of factors, including your claims history, the type of patient interactions you have, the insurance company you are placed with and more. Cunningham Group created this premium estimation tool by drawing from its database of thousands of physician clients. Below are five malpractice estimation premium buckets to gauge how expensive your coverage should be. The buckets are numbered 1 to 5 — with #1 being the least expensive and #5 the most costly.

- Lowest

- Low

- Medium

- High

- Highest

Find Coverage for your Practice

-

Individual Physicians

Learn MoreFind peace of mind for your practice. Allow us to locate suitable malpractice coverage from top providers, offering multiple quotes for your convenience.

-

Tail Coverage

Learn MoreSecure your future with Tail Insurance. Protect yourself from past claims with extended liability coverage—multiple quotes to match your needs.

-

Medical Directors

Learn MoreLead confidently with comprehensive malpractice coverage. We specialize in finding tailored plans from various providers for medical directors like you.

-

Telemedicine Coverage

Learn MoreNavigate the virtual frontier with confidence. We help find comprehensive malpractice coverage for telemedicine practitioners, offering multiple quotes.

-

Moonlighting Coverage

Learn MoreMoonlight with confidence when you have the right protection. Get various malpractice coverage options, ensuring you’re covered wherever you practice.

-

Surgeons

Learn MoreLet us identify the ideal malpractice coverage from top providers so you can focus on excellent surgical outcomes.

-

OBGYNs

Learn MoreSecure specialized malpractice coverage for women’s health. We provide tailored solutions with multiple quotes to meet the specific needs of OBGYNs.

-

Dermatologists

Learn MoreProtect your dermatology practice confidently. We specialize in comprehensive malpractice coverage, delivering multiple quotes so you can choose the one that matches your needs.

Client Testimonials

Below is what a few clients have to say about our prices and service. We know that cost and trust are the two most important factors when shopping for your medical malpractice insurance. We pride ourselves at being the best at both!

Orthopedic Surgeon in OhioAs you know, I was looking for more affordable medical malpractice insurance and found your website online. You were able to obtain the coverage I requested at very competitive prices, and after accepting a quote from one of your insurance carriers, you completed the transaction quickly and efficiently. I would certainly recommend you and your firm to my colleagues.

Podiatrist in OhioI was looking for affordable malpractice coverage on the internet when I came across the Cunningham Group. I had the good fortune to meet Tim Arnieri who sent me multiple affordable quotes the same day. I was very well pleased with the ease of the application process and Tim handled everything. I would highly recommend this group for your professional insurance needs.

How to Get the Best Malpractice Coverage in Ohio

The Ohio market includes both national giants like The Doctors Company, Medical Protective, and ProAssurance, as well as key regional players. Our role is to navigate that market for you:

- We pull quotes from every major insurer to help you compare effectively.

- We explain your policy options clearly, claims-made vs. occurrence, limits, tail coverage, and more.

- We help you identify potential discounts based on experience, risk protocols, or group affiliations.

- We re-shop your policy at renewal to make sure you’re always current and competitively priced.

Many Ohio physicians we work with see savings of 30–50% compared to going direct with one insurer, without compromising coverage scope.

Historic Medical Malpractice Insurance Rates in Ohio for Physicians

Frequently Asked Questions: Ohio Medical Malpractice Insurance

Is malpractice insurance mandatory in Ohio?

Not by statute, but most healthcare facilities require it for credentialing and employment.

What are typical limit amounts?

$1 million per claim / $3 million per aggregate is common and widely accepted.

Do location factors affect rates?

Ohio is generally rated as a single territory; personal and practice-specific factors influence your premium more than location.

Do I need tail coverage?

Yes, if you’re on a claims-made policy and plan to change roles or retire. Occurrence policies eliminate that need, but usually cost more.How can I get better pricing without sacrificing protection?

Work with a broker who shops across all carriers and aligns policy features to your practice needs.

Get a Quote from All Major Ohio Carriers

- Medical Protective

- The Doctors Company

- ProAssurance

- Coverys

- Lonestar

- Aspen

- Positive

One form. Every top carrier. Your best rate, without the hassle.

Resources for Ohio Physicians

The Ohio State Medical Association

Medical Malpractice Insurance Guide

Ohio Department of Insurance

Ohio Hospital Association

State Medical Board of Ohio

Ohio Osteopathic Association

Ohio Medical Group Management Association

Ohio Medicaid

All MD Ohio Healthcare Defense Attorney Listing